When investors think of the market’s best growth stocks, the same familiar mega-cap names like Nvidia (NVDA), AMD (AMD), and Microsoft (MSFT) usually come to mind. But this year’s standout performer isn’t riding on just hype. AppLovin (APP) is achieving tremendous growth by quietly scaling its platform using artificial intelligence (AI)-powered technology while producing significant cash flow. Furthermore, its inclusion in the S&P 500 Index signals that expectations are rising.

AppLovin stock has surged 122% year-to-date (YTD), outperforming most in the “Magnificent Seven” group. Let’s see if now is a good time to buy APP stock.

A Strong Quarter Built on Core Momentum

AppLovin, valued at $244.88 billion, is a technology company that helps mobile app creators sell, monetize, and expand their apps, particularly in mobile gaming. Simply put, AppLovin serves as a behind-the-scenes growth engine for mobile games, linking advertisers with users and assisting developers in scaling quickly, making it one of the most powerful ad-tech platforms in mobile gaming today.

One of the most significant recent achievements was AppLovin's inclusion in the S&P 500 ($SPX). However, management claims that this puts pressure on the company to enhance its performance to meet expectations. Its third-quarter results indicate that AppLovin is on the right track. AppLovin runs an ad platform that helps app developers find new users. Its AI-powered software shows ads to people most likely to download and engage with an app, which drives higher returns on ad spend for advertisers.

In Q3, total revenue increased 68% year-on-year (YoY) to $1.4 billion, owing mostly to model upgrades in the core gaming sector. Adjusted EBITDA was $1.16 billion, up 79% YoY, with an outstanding margin of 82%. Net income rose 92% to $836 million. Core models delivered multiple incremental improvements, and the company’s Max supply-side platform continued to grow at very healthy rates. In the quarter, international expansion also advanced faster than expected. The company extended foreign traffic to advertising marketing websites or shops ahead of schedule, increasing its reach and creating the framework for a broader global advertiser base.

In October, the company launched its self-service platform and referral form. Management stated that early data revealed that the platform had efficiently filtered out low-quality ad accounts, and spending from self-service advertisers was already increasing by around 50% week over week. Looking ahead, the company's priority continues to be model improvement. It intends to continue refining onboarding routines while incorporating additional AI agents into workflows to provide a seamless experience for new advertisers.

Free cash flow totaled $1.049 billion, a 92% increase YoY, indicating both profitability and disciplined capital management. The balance sheet also remains robust. The company ended the quarter with $1.7 billion in cash and cash equivalents. Shareholder returns remain a priority for the company, with approximately 1.3 million shares repurchased for $571 million during the quarter. The company also increased its share repurchase authorization by an additional $3.2 billion.

Looking ahead, management guided continued growth. For 2025, revenue is expected to be between $1.57 billion and $1.6 billion, representing 12% to 14% sequential growth. Adjusted EBITDA is projected between $1.29 billion and $1.32 billion, with margins holding strong in the 82% to 83% range. Analysts are forecasting rapid top-line and bottom-line growth. Revenue is expected to rise 22.1% to $5.7 billion, while earnings are projected to more than double (up 106.4%) in 2025. Looking ahead to 2026, both revenue (up 35.6%) and earnings (up 55.6%) are expected to keep growing at an unusually fast pace. Trading at 47x forward 2026 earnings, the stock is not cheap. Investors are already paying a premium for future growth, meaning the market expects these forecasts to be met or exceeded.

Why This Growth Story Stands Out

AppLovin’s growth story is defined not just by rapid top-line expansion but by extraordinary margins, strong cash generation, disciplined capital returns, and a clear AI-driven roadmap. Furthermore, inclusion in the S&P 500 is already bringing broader visibility and long-term investors into the stock. If the company delivers on the aggressive growth and earnings expectations, the valuation can be justified.

Is APP Stock a Buy on Wall Street?

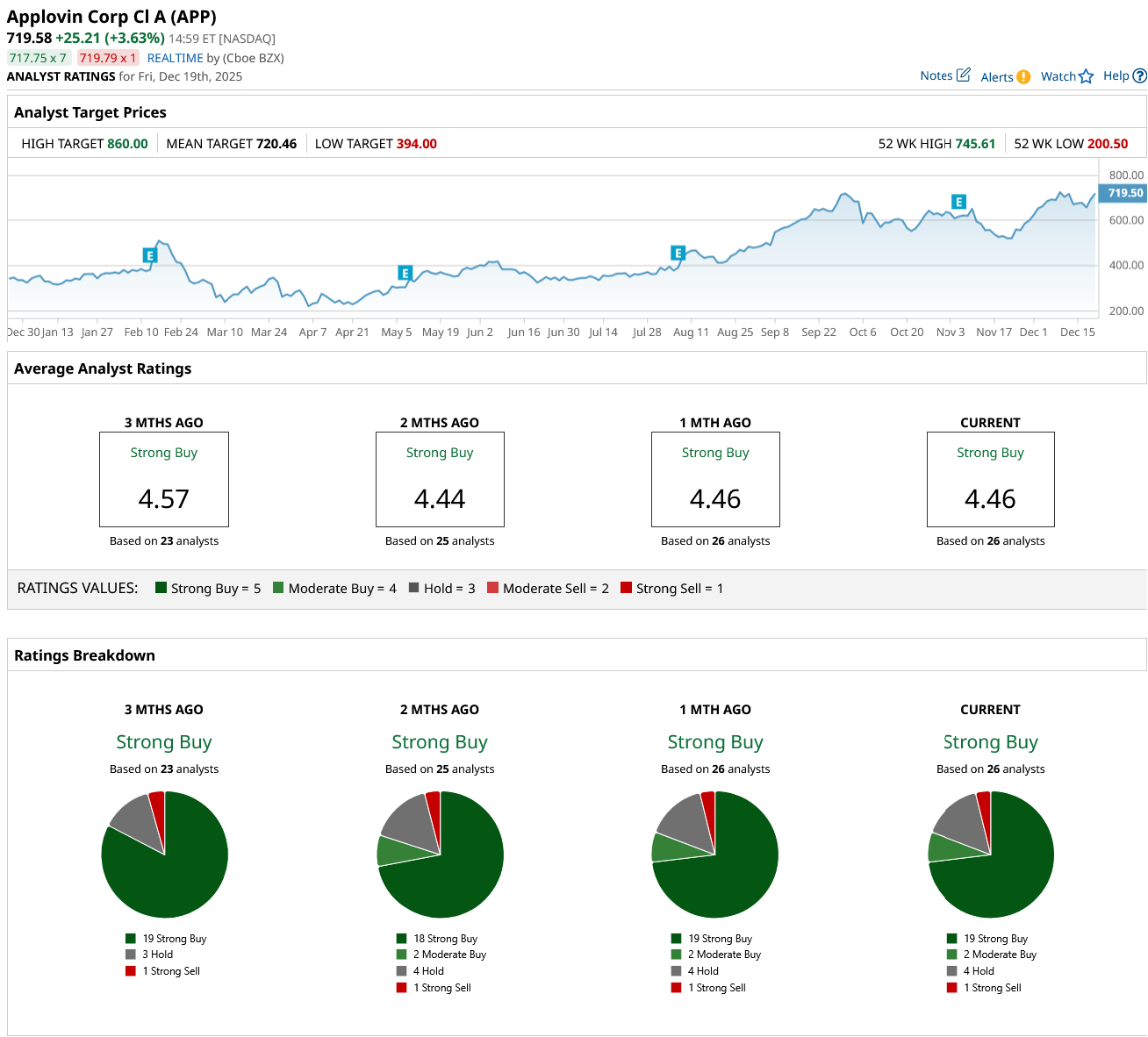

APP stock has all the love on Wall Street, holding an overall “Strong Buy” rating. Recently, BTIG raised its price target for APP to $771 from $705 while reiterating a “Buy” rating, signaling growing confidence in the stock’s outlook. The firm is constructive on the gaming and gambling end markets heading into 2026.

Out of the 26 analysts who cover APP stock, 19 rate it as a “Strong Buy,” while two rate it as a “Moderate Buy,” four rate it a “Hold,” and one rates it a “Strong Sell.” The average target price of $720.46 is just a hair above current levels. However, the high price estimate of $860 implies that the stock could rally by up to 20% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart