Beyond Meat (BYND) has started the month on a largely positive note with shares currently up nearly 35% versus the end of November.

The recent rally has even pushed BYND handily above its 20-day moving average (MA), signaling bulls may remain in control in the near-term.

Despite this week’s surge, Beyond Meat stock remains down over 80% versus its year-to-date high.

Is It Worth Buying Beyond Meat Stock?

Despite the aforementioned technical setup that indicates upward momentum ahead, investors are cautioned against chasing the rally in BYND shares.

Why? Because it’s entirely driven by meme stock enthusiasts, not fundamental developments that improve the operational outlook of the plant-based meat specialist.

The company recently opted for debt refinancing that reduced its total obligations to roughly $240 million. However, that required issuing about 316 million new shares, which massively diluted its existing investors.

What’s also worth mentioning is that even after this week’s rally, Beyond Meat continues to hover around the $1 level – reinforcing that the risk of it getting delisted from Nasdaq remains on the table.

Financials Warrant Unloading BYND Shares

Investors must practice caution in playing Beyond Meat at current levels also because it’s a penny stock notorious for excess volatility.

The meme-driven rallies like the one that BYND has experienced in recent days are known to end up hurting late investors.

Last month, the El Segundo-headquartered firm reported its quarterly financials that did not show any signs of a turnaround in sales or adjusted EBITDA.

In Q3, Beyond Meat’s revenue declined more than 13% on a year-over-year basis while its adjusted EBITDA loss jumped to $21.6 million, reinforcing that BYND stock remains unattractive heading into 2026.

How Wall Street Recommends Playing Beyond Meat

Wall Street analysts also recommend keeping on the sidelines primarily because of the speculative nature of Beyond Meat shares.

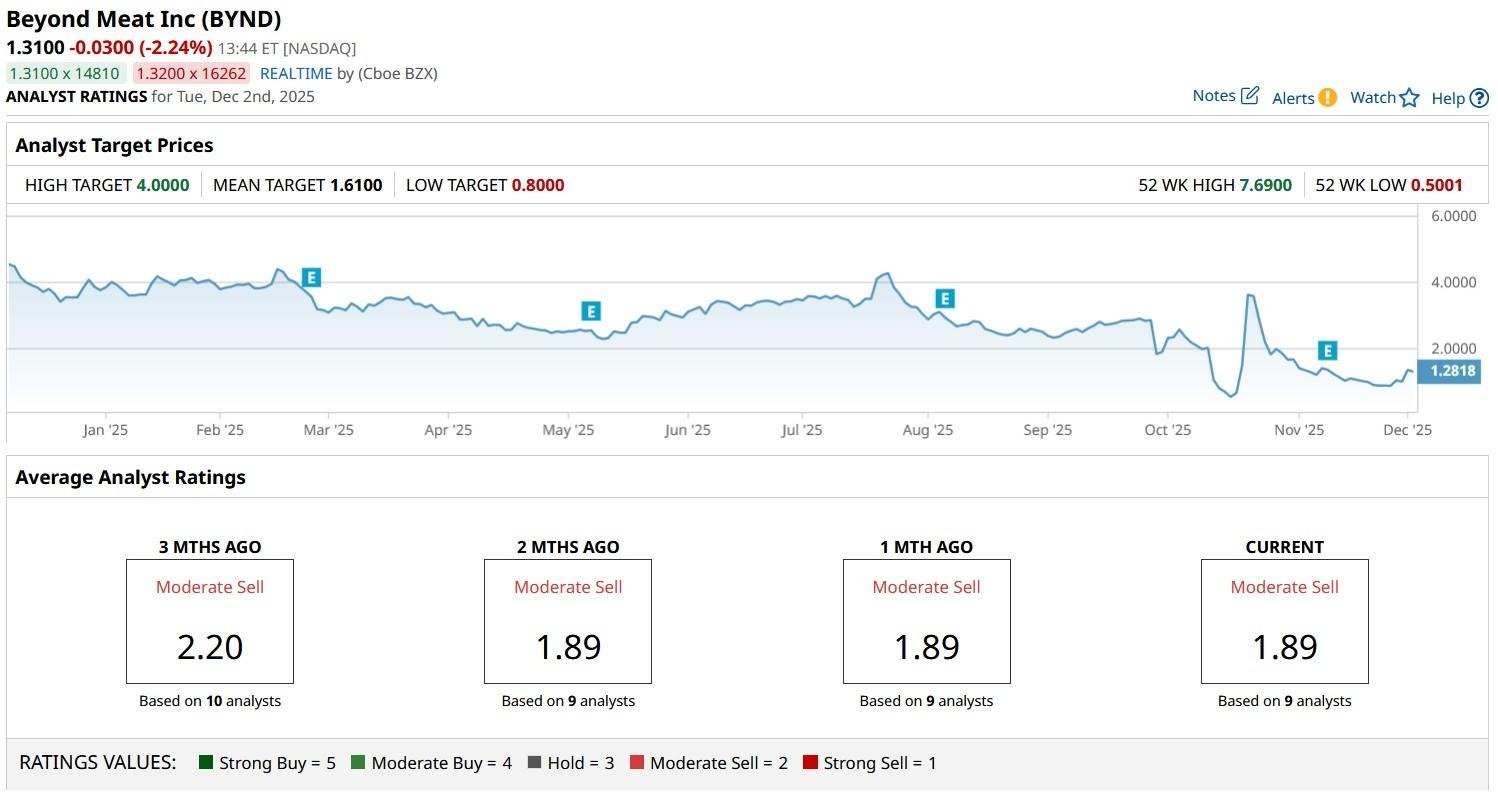

According to Barchart, the consensus rating on BYND stock currently sits at “Moderate Sell.” The mean target of $1.61, however, indicates potential upside of more than 20% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.

- How Micron Stock Could Be an Even Bigger Winner Than GOOGL from a Google-Meta Deal

- Beyond Meat Just Broke Through This Key Resistance Level. Should You Buy the Meme Resurgence in BYND Stock?