Valued at a market cap of $26.8 billion, Synchrony Financial (SYF) is a leading consumer financial services company that provides a wide range of credit products, including credit cards, consumer installment loans, and deposit products. The company partners with major retailers and industries to offer customized financing and payment solutions across diverse sectors such as healthcare, retail, and automotive.

Shares of the Stamford, Connecticut-based company have outperformed the broader market over the past 52 weeks. SYF stock has returned 30.9% over this time, while the broader S&P 500 Index ($SPX) has rallied 17.5%. However, shares of SYF are up 14.4% on a YTD basis, lagging behind SPX’s 15.6% gain

Focusing more closely, shares of the consumer credit company have also outpaced the Financial Select Sector SPDR Fund's (XLF) 12.6% rise over the past 52 weeks.

Despite beating Q3 2025 expectations with EPS of $2.86 and net interest income of $4.72 billion, Synchrony Financial’s shares fell 2.9% the next day as the company lowered its full-year net revenue guidance midpoint to $15.05 billion from the prior $15.15 billion. The guidance cut signaled softer growth momentum, driven partly by elevated payment rates that reduced interest income.

For the fiscal year ending in December 2025, analysts expect SYF’s EPS to grow 34.6% year-over-year to $8.87. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

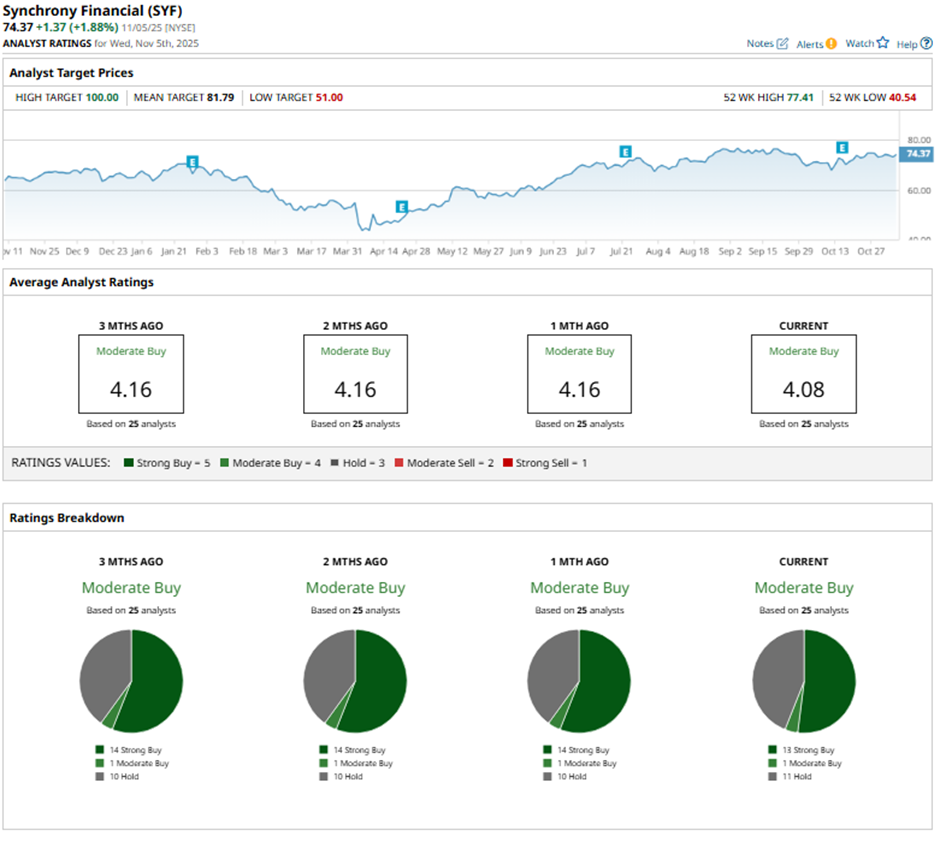

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and 11 “Holds.”

This configuration is slightly less bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Oct. 17, Truist lowered its price target on Synchrony Financial to $78 and maintained a “Hold” rating.

The mean price target of $81.79 represents a premium of nearly 10% to SYF's current levels. The Street-high price target of $100 implies a potential upside of 34.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart