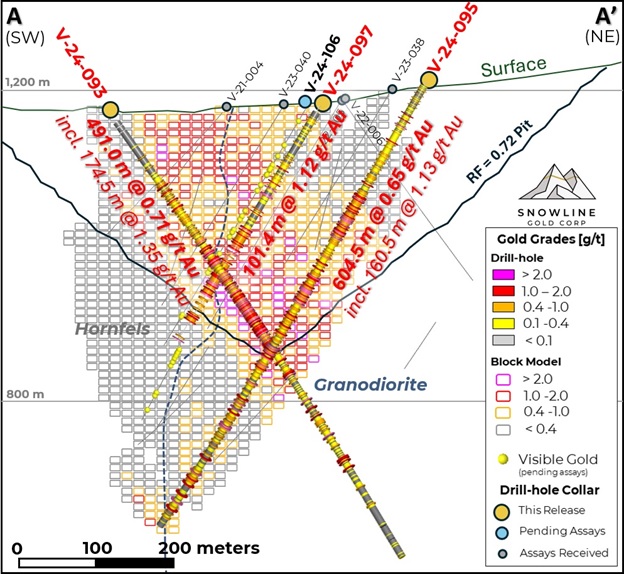

Hole V-24-096 returned 1.08 g/t Au over 386.0 m from surface, including 2.00 g/t Au over 120.5 m, locally outperforming the mineral resource estimate block model

Hole V-24-095 returned 604.5 m from surface at 0.65 g/t Au, including 160.5 m at 1.13 g/t Au, with the bottom 189.5 m of interval outside of mineral resource estimate

Assays remain pending for >15,000 m from 38 holes across four targets at Snowline's Rogue and Einarson projects.

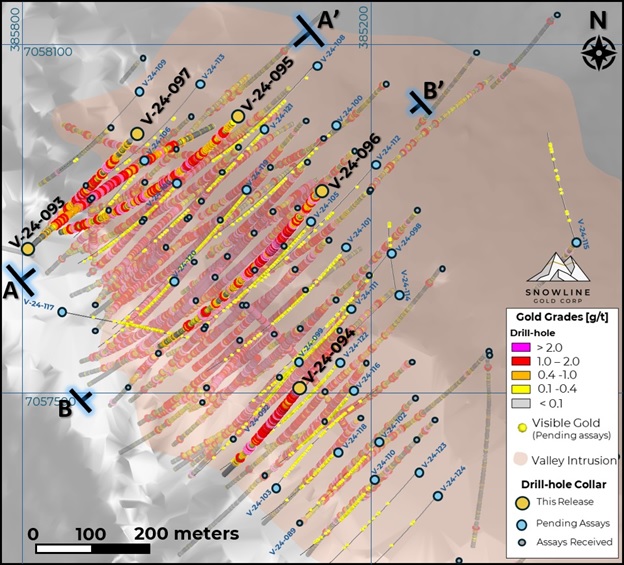

VANCOUVER, BC / ACCESSWIRE / December 4, 2024 / SNOWLINE GOLD CORP (TSXV:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce additional analytical results from its 2024 Valley deposit drilling campaign on the Rogue Project in Canada's Yukon Territory alongside updates on regional exploration. Drilling in and around the northwestern part of the Valley deposit (V-24-093, 095 & 097) continues to delineate consistent mineralization within and beyond the limits of the current mineral resource estimate (MRE) for Valley. Towards the northeastern side of the Valley deposit, V-24-096 returned 1.08 g/t Au over 386.0 m from surface, including 2.00 g/t Au over 120.5 m from 139.0 m downhole, outperforming the mineral resource model along its length. The Company awaits analytical results from the majority of its 2024 exploration campaign, including >15,000 m of drilling in 38 holes across four different targets.

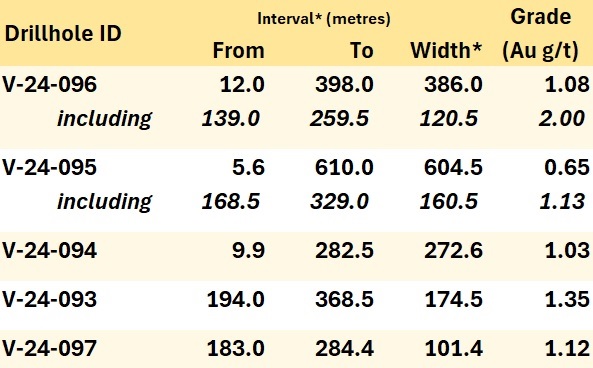

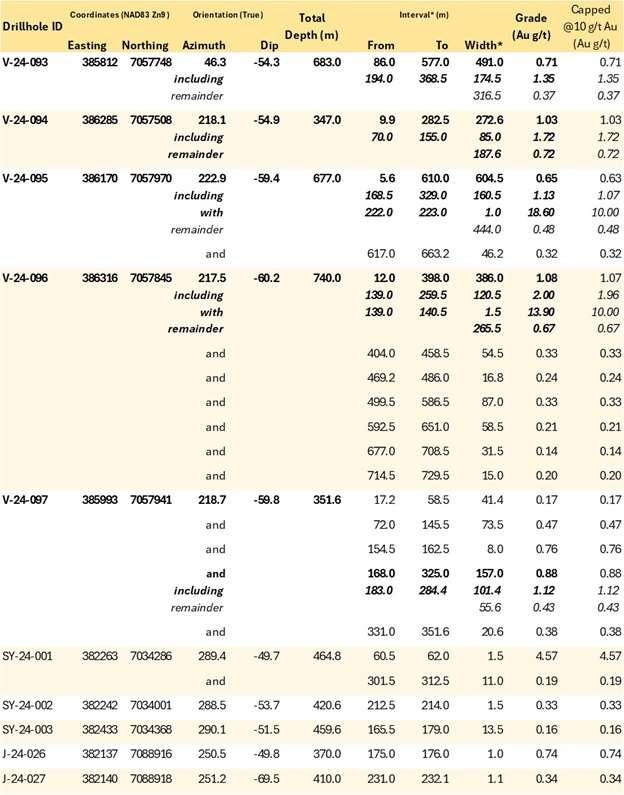

Table 1 -Highlight summary of Snowline's latest assay results; see Table 2 for details. *Interval widths reported.

"Our latest results from Valley continue to advance our goals for the 2024 drilling campaign," said Scott Berdahl, CEO & Director of Snowline. "They upgrade our confidence in the initial mineral resource estimate, and they expand the physical limits of the mineralized system at Valley as we know it. It is exceptional to see such consistency across batch after batch of analytical results-and a hallmark of a top-tier gold deposit. We look forward to assessing the overall contributions of these results to an updated mineral resource estimate for Valley in 2025."

VALLEY DRILLING, ROGUE PROJECT

Hole V-24-096

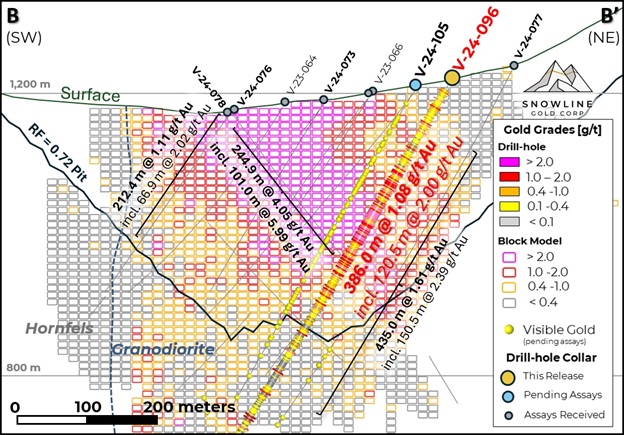

Hole V-24-096 is collared within the Valley intrusion, roughly 53 m northeast of V-23-034 (418.9 m @ 1.9 g/t Au including 216.0 m @ 3.1 g/t Au, see July 5, 2023 news release) and 58 m southeast of V-23-045 (517.9 m @ 1.14 g/t Au from surface, see September 11, 2023 news release). The hole is drilled to the southwest, testing a northeastern extension of strong gold mineralization predicted by the Valley deposit block model.

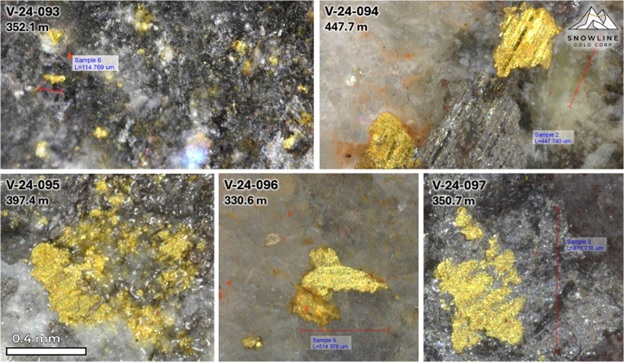

The hole runs through coarse-grained granodiorite for the top 350 m, at which point it transitions to the fine-grained porphyritic unit with localized intrusive breccias. As is seen elsewhere in the deposit, quartz vein densities are high near the transition between the two units, with higher gold grades in the coarse-grained unit proximal to the porphyritic unit. From 674 m to the end of the hole at 740 m the hole returns to coarse-grained granodiorite with generally low quartz vein densities.

The results of this hole complement those of V-24-077 to its northeast (Figure 2), which also exceeded block model expectations based in the initial Valley MRE. These results are expected to help upgrade and de-risk relevant areas of the initial MRE for Valley. The ultimate effect of this result will be quantified along with analytical results of all subsequent holes in an updated MRE at a later time.

ANNUAL EQUITY INCENTIVE AWARDS

The Company has granted a total of 360,000 restricted share units and 100,000 deferred share units (together, the "Equity Incentive Awards") to various employees, consultants, directors, and officers of the Company. The Equity Incentive Awards have been granted pursuant to the Company's Omnibus Incentive Plan and are subject to vesting provisions. The purpose of these awards is to align and incentivize around ongoing contributions, and to recognize contributions made to the growth of the Company and advancement of its projects by personnel at all levels.

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's "Forks" Camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas' preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

For the purposes of this release, contiguous mineralized intervals at Valley are defined as runs of mineralization with no break >5.0 m assaying <0.1 g/t Au and may include any highlight subsections thereof.

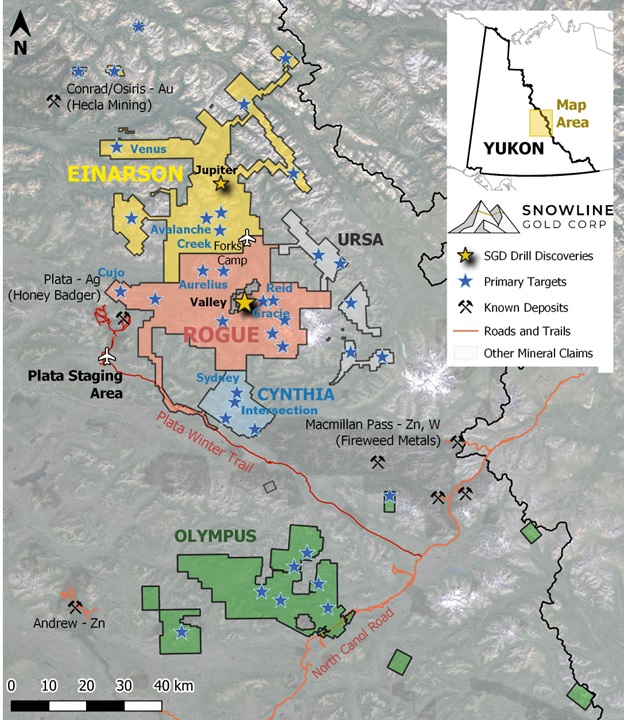

ABOUT ROGUE

Snowline Gold's 100%-owned, flagship Rogue Project, in Canada's Yukon Territory, covers a 60 x 30 km cluster of intrusions in the eastern Tombstone Gold Belt known as the Rogue Plutonic Complex.

Since its launch in 2021, Snowline has progressed the Rogue Project's Valley target from a greenfield prospecting discovery to a significant bulk tonnage gold resource, with 4.05 Moz gold indicated mineral resource at 1.66 g/t Au and an additional 3.26 Moz inferred mineral resource at 1.25 g/t Au within a pit-shell constraint. The resource estimate numbers are supported by the recent technical report for Rogue, prepared in accordance with NI 43-101 standards, entitled "Rogue Gold Project: NI 43-101 Technical Report and Mineral Resource Estimate," authored by Heather Burrell, P. Geo., Daniel J. Redmond, P. Geo., and Steven C. Haggarty, P. Eng., with an effective date of May 15, 2024.

Exploration of the open Valley deposit is ongoing. Valley is a reduced intrusion-related gold system (RIRGS), geologically similar to multi-million-ounce RIRGS deposits currently in production, like Kinross's Fort Knox Mine in Alaska, but with substantially higher gold grades. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion.

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. For these reasons, Snowline considers the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering roughly 360,000 ha (3,600 km2). The Company is exploring its flagship 111,000 ha (1,110 km2) Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits. The Company's first-mover position and extensive exploration database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the significance of analytical results, the significance of visual drill core observations and visible gold, the potential effects of current analytical results on future mineral resource estimates including expansion of the pit shell and de-risking of the current estimate, the discovery potential within the Valley intrusion and on other exploration targets, the potential for investors to participate in multiple future discoveries, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on accesswire.com