Critical minerals are the foundation of modern infrastructure, defense systems, and clean energy technologies—and investors are increasingly paying attention to where these materials come from. One company is starting to earn more interest than others: SAGA Metals Corp. (OTCQB: SAGMF)(TSXV: SAGA) (FSE: 20H). And the interest isn't random- SAGA is attracting attention for all the right reasons.

Foremost is that SAGA isn’t rewriting another exploration play story—it's writing an asset-based and justified bullish verse after securing full control over a rare geological system with proven potential across titanium, vanadium, and iron. That achievement alone puts SAGMF in a different class from most early-stage juniors. Now, with trading activity on the rise and new price highs being tested, the market appears to be catching on.

On June 27, 2025, SAGA reached an intraday high of $0.33, the strongest showing since its December 2024 listing on the OTCQB exchange. And this price action wasn’t an anomaly—it followed a material shift in daily trading volumes that began just days earlier. That happened for excellent reasons.

Video Link: https://www.youtube.com/embed/5eOJ3WGyrcc

An Entire Geological System—Now Controlled by SAGA

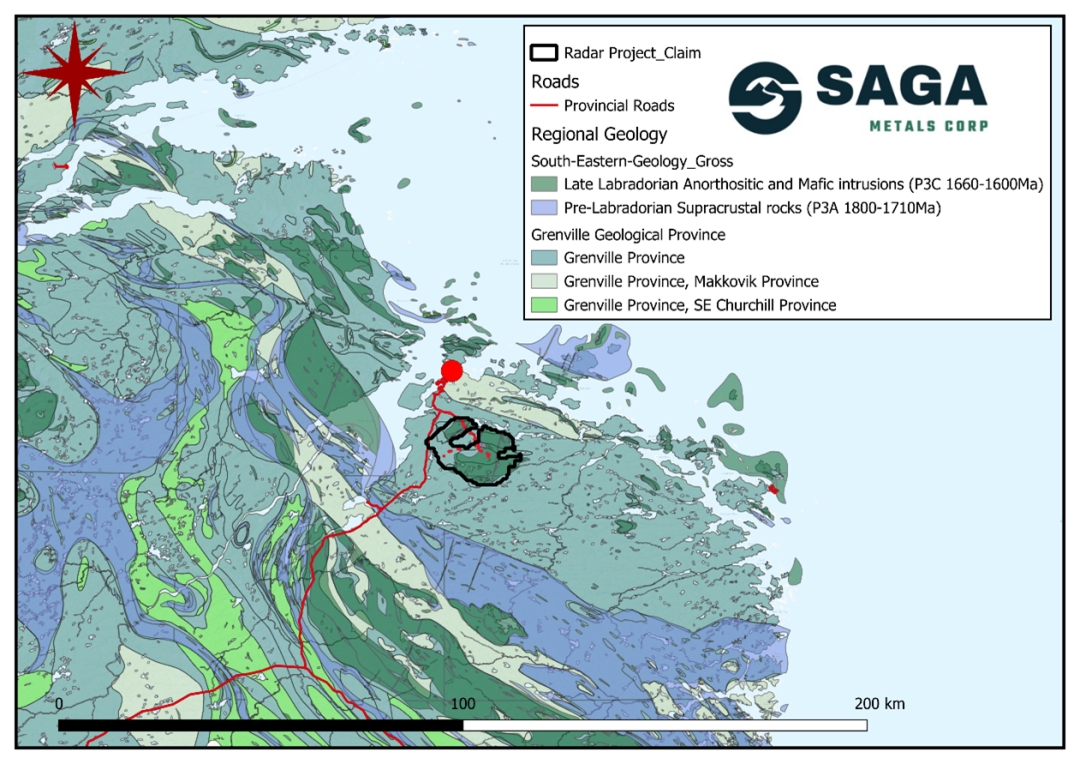

SAGA’s flagship asset, the Radar Ti-V-Fe Project, sits atop a 160 km² titanomagnetite-bearing geologic system known as the Dykes River Intrusion. This is not your typical single-zone target with speculative upside. It’s an entire layered intrusive complex historically held by multiple parties. Through methodical consolidation, SAGA now controls the entire system—something rare in mineral exploration, and almost unheard of in districts of this scale.

This ownership advantage gives SAGA the freedom to explore, delineate, and plan with clarity, flexibility, and full upside exposure. In a space where many juniors are boxed in by fragmented land positions, SAGA owns the whole lot. Owning is great. Having underground assets is even better.

Drill Results That Matter

And SAGA does. Its maiden drill program didn’t just confirm the presence of mineralization—it validated the economic relevance of the system. Among the standout intercepts:

-

193.8 meters grading 34.1% Fe, 7.94% TiO₂, and 0.32% V₂O₅

-

94.2 meters grading 34.2% Fe, 7.71% TiO₂, and 0.32% V₂O₅

These numbers aren’t theoretical. They are comparable—if not superior—to grades found in well-advanced titanomagnetite projects elsewhere in the world, and they cover essential strategic materials. Vanadium, for example, is now considered a critical metal for defense, grid-scale batteries, and aerospace alloys. Titanium, meanwhile, is in increasing demand for its role in lightweight alloys and military-grade hardware.

Infrastructure Is Already There

Still, SAGA can have the best drill results and assays in the business, but if the project is trapped in the tundra with no infrastructure, the valuation ceiling stays low. That’s what makes SAGMF investment proposition so compelling. Its Radar project is already supported by all-weather roads, nearby deepwater ports, low-cost hydroelectric power, and a skilled labor pool in Labrador’s mining-friendly corridor.

In other words, SAGMF isn't visualizing a 10-year dream—it’s a near-term development opportunity. Add to that Canada’s strategic push for domestic critical mineral production, and SAGAMF becomes more than just an exploration story—it becomes a potential policy-aligned partner.

The Market Is Starting to Catch On

Up until late June, SAGA’s trading pattern mirrored that of many overlooked early-stage juniors—thin volume, limited visibility, and flat-lined price action. From December 12, 2024 to June 23, 2025, daily trading volumes ranged from as low as 100 shares to a high of just 6,000. Then something changed.

Beginning June 25, the average daily volume jumped sharply to approximately 24,500 shares—a nearly fivefold increase. That surge in activity wasn’t random. It coincided with a growing awareness of SAGA’s unique positioning in the critical minerals space. Investors are beginning to understand that this isn’t just another exploration play. The company controls an entire 160 km² geologic system in Labrador, has already confirmed high-grade titanium, vanadium, and iron mineralization, and benefits from established infrastructure in a top-tier mining jurisdiction.

Add to that the broader momentum in strategic metals and the growing appetite from institutions looking for secure North American supply—and it’s clear this volume surge represents something more: smart money taking early positions. If this trend continues—and all signs say it will—SAGA may soon transition from a speculative junior to a market-recognized critical minerals contender.

Why Investors Are Paying Attention Now

The recent upward pressure on SAGA’s share price and trading volume isn’t just a product of technical movement—it’s a signal of fundamental revaluation. In a sector filled with companies scrambling to secure land, validate early assays, or fund operations, SAGA Metals already holds a fully consolidated district-scale system rich in titanium, vanadium, and iron.

As importantly, SAGMF's maiden drill program didn’t just check a box—it confirmed economic grades across multiple zones. It operates in a jurisdiction that’s not only geopolitically stable but also equipped with deepwater port access, hydroelectric power, and road connectivity. That means this project isn’t trapped in development purgatory. It’s poised for advancement.

At the same time, macro trends are putting wind in SAGA’s sails. Demand for titanium and vanadium—especially for military applications, aerospace, and grid-scale batteries—is accelerating, and the West is under pressure to localize supply chains. SAGA’s Labrador project puts it in the right place at the right time. The fact that the stock traded thinly for months isn’t a red flag—it’s an opportunity. Now that volume has spiked and price action has followed, it’s clear that investors are beginning to connect the dots. Those who move before institutional capital fully prices in the fundamentals may stand to benefit the most.

Sources and references:

-

https://www.barchart.com/story/news/33263200/not-all-critical-mineral-stocks-are-created-equalsaga-metals-proves-that-point

-

https://www.theglobeandmail.com/investing/markets/markets-news/GetNews/33167352/ownership-matters-how-saga-metals-quietly-secured-the-entire-dykes-river-intrusion/

-

https://markets.financialcontent.com/streetinsider/article/abnewswire-2025-6-27-saga-metals-radar-project-delivers-more-than-just-excellent-grades-its-a-layered-breakthrough/

-

https://markets.financialcontent.com/dailypennyalerts/article/abnewswire-2025-6-25-saga-metals-is-a-critical-minerals-investment-proposition-hiding-in-plain-sight/

-

https://sagametals.com/projects/

-

https://sagametals.com/about-us/#thecompany

-

https://finance.yahoo.com/news/saga-metals-confirms-significant-oxide-130000317.html

-

https://finance.yahoo.com/quote/SAGMF/history/

Disclaimer and disclosures:This Disclaimer and Disclosure statement is a permanent part of this content. Any reproduction of this content that does not include the Disclaimer and Disclosure statement is unauthorized and strictly prohibited. All investments are subject to risk, which must be considered on an individual basis before making any investment decision. This paid advertisement includes a stock profile of SAGA Metals Corp. This paid advertisement is intended solely for information and educational purposes and is not to be construed under any circumstances as an offer to sell or a solicitation of an offer to purchase any securities. In an effort to enhance public awareness, Hawk Point Media Group, Llc. was hired by Shore Thing Media Group, Llc. to create and distribute digital content for SAGA Metals Corp. Shore Thing Media Group, Llc. compensated Hawk Point Media Group, Llc. USD five-thousand-dollars via wire transfer to complete and distribute these services. This advertisement is being disseminated for a period of one month beginning on 06/24/25 and ending on 07/23/25. Hawk Point Media Group, Llc. owners, officers, principals, affiliates, contributors, and/or related parties do not own, intend to own, sell, or intend to sell SAGA Metals Corp. stock. However, it is prudent to expect that those hiring Hawk Point Media Group, Llc, including that company’s owners, employees, and affiliates may sell some or even all of the SAGA Metals Corp. shares that they own, if any, during and/or after this engagement period. If successful, this advertisement will increase investor and market awareness of SAGA Metals Corp. and its securities, which may result in an increased number of shareholders owning and trading the securities, increased trading volume, and possibly an increase in share price, which may be temporary. This advertisement does not purport to provide a complete analysis of SAGA Metals Corp. or its financial position. The agency providing this content are not, and do not purport to be, broker-dealers or registered investment advisors. This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a registered broker-dealer or registered investment advisor or, at a minimum, doing your own research if you do not utilize an investment professional to make decisions on what securities to buy and sell, and only after reviewing the financial statements and other pertinent publicly-available information about SAGA Metals Corp. Further, readers are specifically urged to read and carefully consider the Risk Factors identified and discussed in SAGA Metals Corp. SEC filings. Investing in microcap securities such as SAGA Metals Corp. is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, Hawk Point Media Group, Llc. cannot guarantee the accuracy or completeness of the information and are not responsible for any errors or omissions. This advertisement contains forward-looking statements, including statements regarding expected continual growth of SAGA Metals Corp. and/or its industry. Hawk Point Media Group, Llc. note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect SAGA Metals Corp. actual results of operations. Factors that could cause actual results to vary include the size and growth of the market for SAGA Metals Corp. products and/or services, the company’s ability to fund its capital requirements in the near term and long term, federal and state regulatory issues, pricing pressures, etc. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. Hawk Point Media Group, Llc. are not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: info@hawkpointmedia.com

Country: United States

Website: https://hawkpointmedia.com/