Wrapping up Q3 earnings, we look at the numbers and key takeaways for the online retail stocks, including Wayfair (NYSE: W) and its peers.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

The 6 online retail stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 1.1% below.

Luckily, online retail stocks have performed well with share prices up 11.4% on average since the latest earnings results.

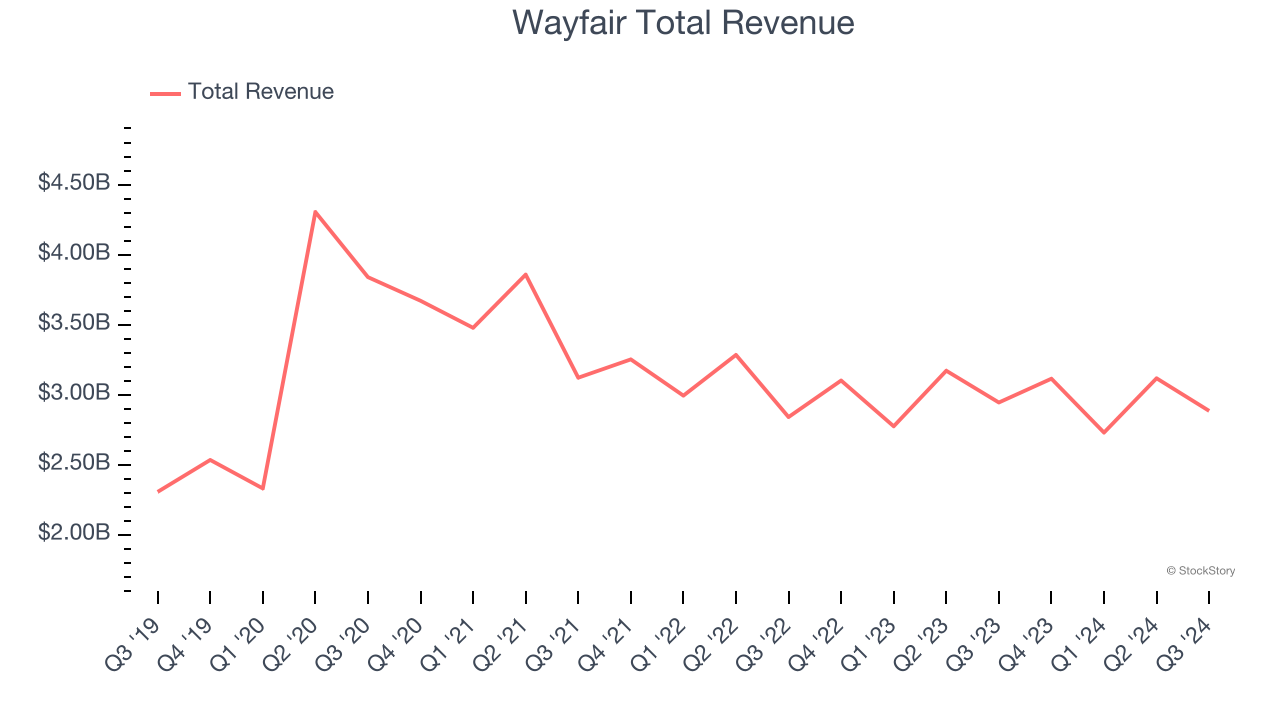

Weakest Q3: Wayfair (NYSE: W)

Founded in 2002 by Niraj Shah, Wayfair (NYSE: W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $2.88 billion, down 2% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ number of active customers estimates and a decline in its buyers.

"Q3 marked another proofpoint of resilience for Wayfair with further market share capture in the face of sustained challenges in the category. Once again, we navigated a dynamic consumer environment while driving further discipline on costs to achieve a mid-single-digit Adjusted EBITDA margin for the second quarter in a row. As I've mentioned before, our north star is driving Adjusted EBITDA dollars in excess of equity-based compensation and capital expenditures, and we're pleased to be making noteworthy improvements across each of these fronts," said Niraj Shah, CEO, co-founder and co-chairman, Wayfair.

Wayfair delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The company reported 21.7 million active buyers, down 2.7% year on year. Interestingly, the stock is up 11.4% since reporting and currently trades at $47.70.

Read our full report on Wayfair here, it’s free.

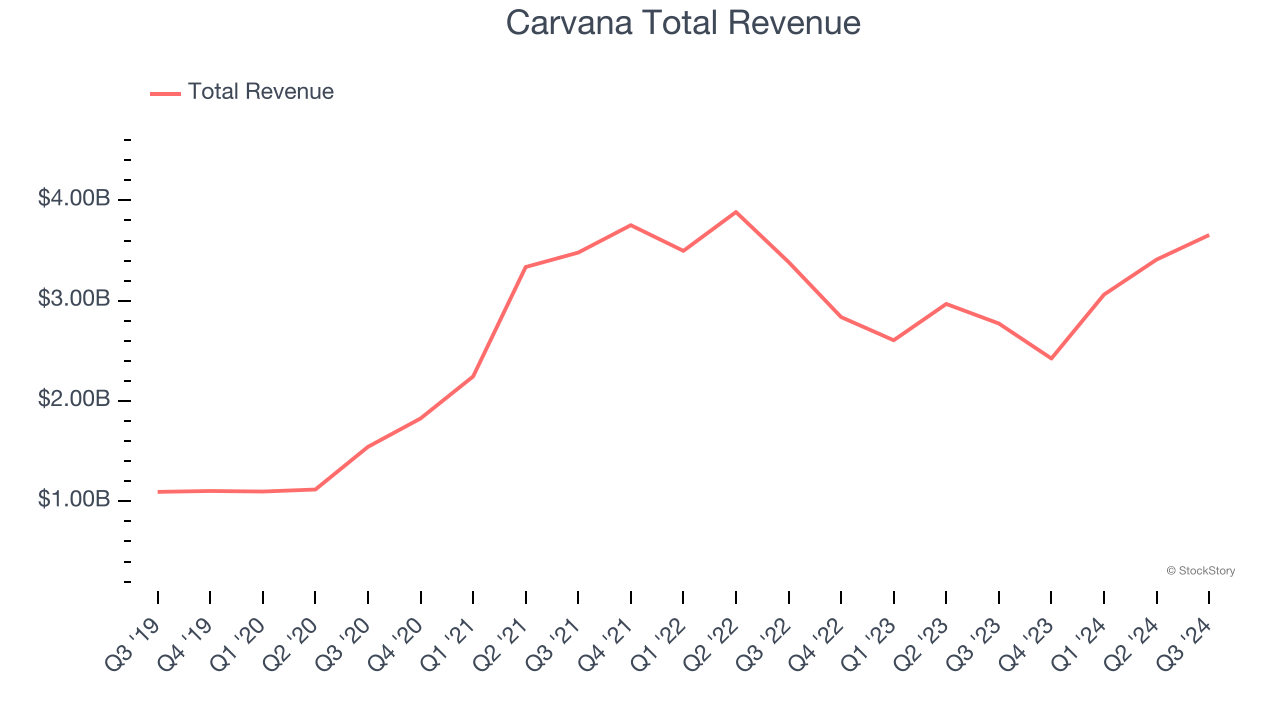

Best Q3: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $3.66 billion, up 31.8% year on year, outperforming analysts’ expectations by 5.7%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

Carvana achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 31.9% since reporting. It currently trades at $273.39.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $187.8 billion, up 10.5% year on year, in line with analysts’ expectations. Still, it was a satisfactory quarter as it posted a solid beat of analysts’ EPS estimates.

As expected, the stock is down 3.4% since the results and currently trades at $230.63.

Read our full analysis of Amazon’s results here.

Chewy (NYSE: CHWY)

Founded by Ryan Cohen, who later became known for his involvement in GameStop, Chewy (NYSE: CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

Chewy reported revenues of $2.88 billion, up 4.8% year on year. This print surpassed analysts’ expectations by 0.7%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

The stock is up 12.6% since reporting and currently trades at $37.80.

Read our full, actionable report on Chewy here, it’s free.

Revolve (NYSE: RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ: RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

Revolve reported revenues of $283.1 million, up 9.9% year on year. This number beat analysts’ expectations by 4.4%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and a narrow beat of analysts’ number of active customers estimates.

The company reported 2.63 million active buyers, up 4.7% year on year. The stock is up 22.9% since reporting and currently trades at $31.99.

Read our full, actionable report on Revolve here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.