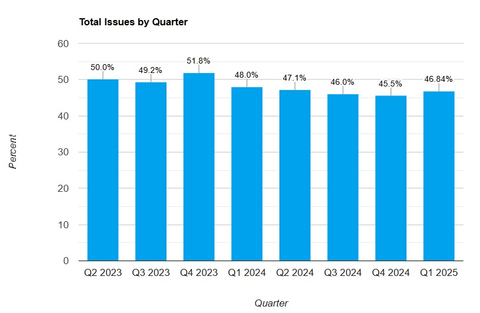

During Q1 2025 46.8% percent of transactions on a ~$80bn portfolio comprising of residential, commercial and business purpose loans had issues leading to a risk of wire & title fraud. On average, problematic loans had 2.5 issues per loan which is a new record, indicating the lack of appropriate controls by closing agents and lenders to identify and fix issues.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250417048051/en/

Q1 2025 saw record-high risk levels for CPL validation related errors (10.8% of transactions) for critical data points such as borrower information, vesting / vested parties, non-borrowing parties on title, property addresses, borrower information and more. This is another example of a lack of accuracy between lender and title systems alongside the CPL issues that hit all-time high levels in the last quarter of 47.7% of transactions.

There were wire related errors at 8.4% of transactions in Q1, the 6th straight quarter with over 8% for this category. License issues remained at elevated levels from Q4 2024 to Q1 2025 due to entities having lapsed, terminated, or suspended licenses and inconsistent data when verified with registrars, insurance regulators and licensing bodies. These persistently high levels combined with the CPL Validation and key data element mismatch highlight the need for source data verification in workflows and for trusted data sets being used as part of critical processes.

Decision-ready data from trusted sources will remain a cornerstone of the mortgage and real estate finance industry. AI solutions have the potential to significantly enhance automation, collaboration, and process improvement, resulting in improved customer experience and pricing. Automation goals from lenders seeking efficiencies in their LOS, POS and during the real estate journey all require decision ready data and real-time verification using live repositories, these are essential for responsible and efficient AI initiatives.

Some additional context, during Q1 2025 where we saw further focus on wire fraud, title fraud and closing agent risk management including more attention to closing agent risk management at the GSEs. FundingShield received requests for data from many of its lender clients that sell to Fannie Mae who recently underwent Mortgage Origination Risk Assessment (MORA) Audits during Q1 2025.

Fannie Mae MORA Audit – Title Risk Focus:

The clients were undergoing typical Mortgage Origination Risk Assessment (MORA) audit requests. Fannie Mae had reached out to our clients, asking them to confirm the risk framework, measurement, and tracking the lender used to conduct transaction-level risk reviews of the closing agent, the title insurance firm, and transaction-specific details at the time of closing on each loan sold to them. This did not mean having a database of approved agents last updated “X” days, months, or years ago, but rather that the check was done at the time of closing and was transaction specific.

- Transaction-Specific Checks: Lenders were required to perform checks at the time of closing, ensuring that each transaction was reviewed individually. "It's crucial that these checks are done for each transaction to mitigate risks effectively," emphasized a Fannie Mae representative.

- Documentation and Evidence: Lenders had to document and provide evidence of a framework for confirming recourse back to rated title insurance firms, the use of licensed parties, and steps taken to confirm the compliance of the agent with local insurance and escrow laws. Providing thorough documentation is essential to demonstrate compliance and risk management.

- Rising Market Risks: This requirement indicates rising risks in the market due to concerns around cybersecurity, data security, and credit risk. The increasing focus on cybersecurity and data security reflects the growing threats in the financial sector that are front and center as evidenced by increasing wire and title fraud attempts by first party and third-party (Cyber based) actors.

Implications:

- Higher Expectation of Recourse: Fannie Mae's validation of steps taken by sellers indicates a higher expectation of risk and a need to further confirm recourse from title insurance firms for loans sold to the GSE. Ensuring recourse back to rated title insurance firms is a critical step in managing credit risk. FundingShield’s transaction level reviews that confirm license, coverage, bank data, title insurer system validation and remediation of issues and much more pre-closing, is a market standard to manage this risk effectively.

Analytics Q1 2025 vs Q4 2024:

- Q4 had a new record for number of CPL Validation issues at ~10.85% of transactions having voided documents, incorrect or non-matching data / documents, different addresses or borrower information, or incorrect vesting structures.

- CPL-related issues reached new record levels of 47.7% of transactions.

- 8.41% of transactions had wire related issues, this is the 6th quarter in a row, above 8%.

- Insurance related coverage issues remained under 1% where 0.65% of the parties in transactions where such entities did not carry sufficient insurance coverage.

- License issues were found in nearly 1.7% of the parties in transactions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250417048051/en/

Fannie Mae's validation of steps taken by sellers indicates a higher expectation of risk and a need to further confirm recourse from title insurance firms. FundingShield’s transaction level review is a market standard to manage these evolving risks.

Contacts

Media Inquiries

FundingShield LLC

+1 949-706-7888

info@fundingshield.com